Exit Strategies & Buy Right – Creating Competitive Advantage

Flux is the new normal and organic growth is increasingly elusive. For many, the solution lies in consolidating fragmented sectors through M&A activity and for some simply, ‘stop – I want to get off’. So, how has the M&A arena changed post-Covid – valuations, buying, selling, funding, MBO’s and Employee Ownership Trusts? What are the current trends, and how can you gain best advantage?

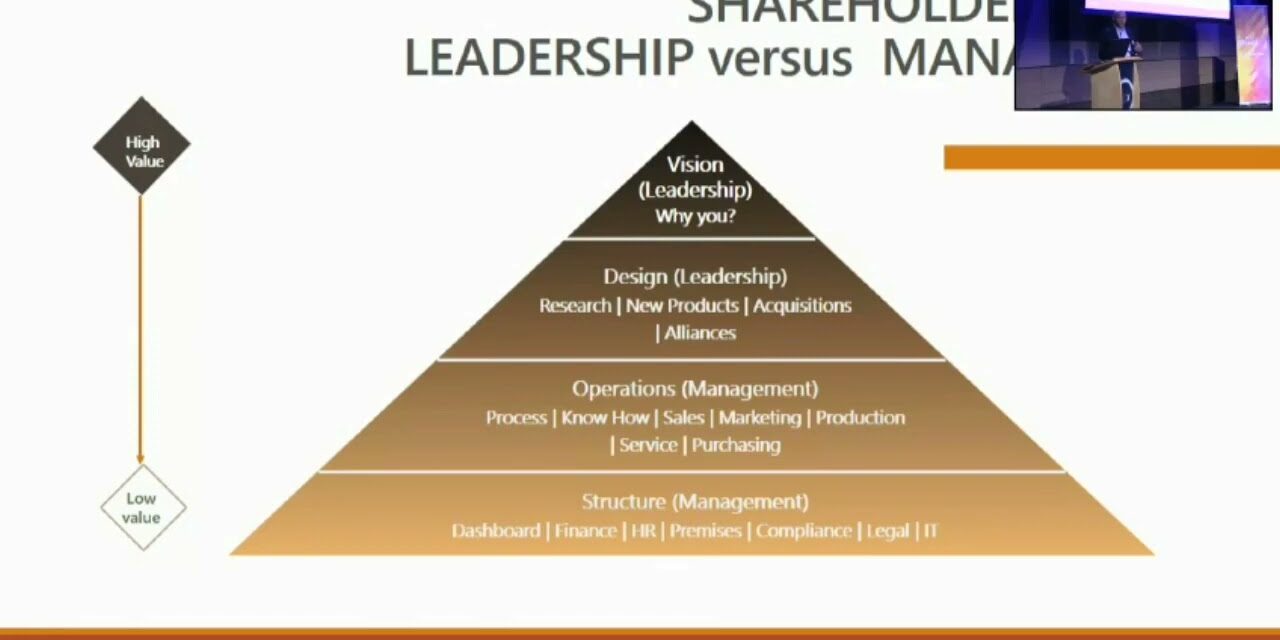

Lead Ahead

Despite pandemic-driven volatility, the opportunities for growth remain boundless. How do leaders resolve challenges and build more valuable, purposeful organisations?

Investment, Mergers and Acquisitions

In slow growth markets consolidation brings synergy, economies of scale and shareholder value. How do you buy or sell companies and secure corporate funding?

Living on Thin Air

Today, every business is a technology business and a brand. How do you harness both to increase productivity and create a ‘we want, we need motivation’?

Growth Strategy

You know ‘why’, but ‘how’ and ‘what’ are less obvious today. How do you set the direction with clarity, confidence, and energy? How can you positively disrupt your market and design your business to scale?

About Avondale Corporate

Avondale is a leading M&A business advisor that helps ambitious owners buy or sell companies, secure investment, grow their business and enhance shareholder value. Audacious, authentic, and ambitious partners of exceptional quality, delivering your success. We have been advising dynamic entrepreneurs and companies for almost 30 years. We operate throughout the UK with global reach and research resource.

If you would like to discuss any aspect of our services in confidence or would like some advice, please call +44(0)20 7788 8250, email us on av@avondale.co.uk or find our Contact Us page here.