The Market

Currently, there is a mixed outlook on mergers and acquisitions (“M&A”) activity, reflecting global trends across many industries. While numerous sectors face both productivity challenges and economic headwinds, abundant capital remains available and is likely to become cheaper as interest rates ease. To be blunt, British productivity has stagnated since pre-2009, with Brexit, Covid and the Ukraine war all contributing to the slowdown. However, this is true for many developed nations, and the UK remains an attractive destination for investors and businesses alike.

For clients in the emerging mid-market deal range – £2–£40 million – buying and selling companies will most likely continue at moderate levels. That said, we have seen an upturn in large corporate enquiries and offers compared to the same period in 2024. This reflects the lower relative cost of acquisitions whilst these businesses are still looking to deliver new ideas, services, and expanded market access. This is particularly pertinent for international businesses which benefit from favourable exchange rates. High-quality businesses with strong growth prospects continue to command good premiums, but sellers and their advisors may need to think globally to find the right buyers.

Energy, technology, consulting, and certain areas of manufacturing remain in demand. However, many dealmakers are still cautious about Business-2-Consumer (B2C). As interest rates decline, consumer spending should recover, and we might reasonably expect this caution to ease. Additionally, there are still too few high-quality, prepared B2C assets available for acquisition, which strengthens the seller market in this space.

In summary, the right strategic M&A can create synergies and economies of scale, offsetting margin pressures and driving shareholder value where organic growth is limited. There is also still plenty of “dry investment powder” allocated to fund such deals, therefore activity and expectations are in line for a moderate M&A year after 2024 which was down in terms of deal volumes – although Avondale, saw a volume increase.

Key M&A Statistics 24

Overall, the UK’s M&A market in the first half of 2024 demonstrated resilience and adaptability, with a clear trend towards larger, high-value deals and increased foreign investment. In 2024, the UK’s private equity (“PE”) landscape exhibited a nuanced performance, with initial challenges giving way to a more robust second half (source pwc.co.uk).

| Metric | Details |

| Total M&A Deal Value | £68 billion (+66% YoY) |

| Total M&A Transactions | 1,703 deals (-20% YoY) |

| High-Value Transactions | 16 deals >£1bn (Total: £42bn) vs. 7 deals (£17bn) in H1 2023 |

First Half of 2024:

The mid-market segment saw an 11% decrease in PE transactions, with a total of 321 deals compared to 360 in the same period of 2023. Across all market segments, 656 PE deals were completed, reflecting a 20% decline from the 822 transactions recorded in the first half of 2023. Despite the downturn, UK companies remained attractive to foreign investors, with inbound deals accounting for 42% of all M&A activity. Interestingly, nearly half of these international buyers were based in the United States (kpmg.com).

| Metric | Details |

| Mid-Market Activity | 321 deals (-11% YoY) |

| Overall PE Transactions | 656 deals (-20% YoY) |

| International Interest | 42% of M&A deals were inbound; nearly half of international buyers from the U.S. |

Second Half of 2024:

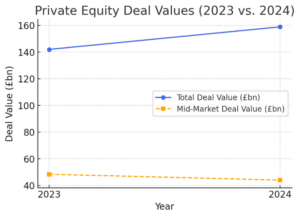

The latter half of the year experienced a significant uptick, culminating in 1,699 PE transactions for 2024, representing a 4.4% increase on the previous year. The total value of these deals reached £158.9 billion, an increase of almost 12% from 2023, the highest level since the first half of 2022. The mid-market segment recorded its highest deal volumes in the second half of 2024. While volumes increased by 15.5% year-on-year, the overall deal value saw a 9.1% decline to £44 billion. This decrease is attributed to smaller deal sizes and a rise in bolt-on investments, which grew by 17.5% compared to 2024 (source accountancytoday.co.uk).

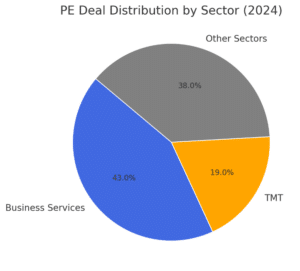

Sector Highlights:

This sector dominated the PE deal landscape, accounting for 43% of total deals in 2024 – a 10% increase from the prior year. Emerging as a focal point, the TMT sector saw deal volumes rise by nearly 19% year-on-year, with cumulative values soaring by almost 58%, totalling over £40 billion (source accountancytoday.co.uk).

Taxes

The Autumn 2024 budget delivered an unwelcome but expected, increase in Capital Gains Tax (“CGT”). From 2025, the amount of CGT due on the sale of a business in the UK will depend on whether you qualify for Business Asset Disposal Relief (“BADR”) (formerly Entrepreneurs’ Relief) or not:

- If BADR applies (up to the £1 million lifetime limit): The CGT rate was increased to 14% from 10% and will further increase to 18% in April 2026.

- For gains above the £1 million BADR limit or where BADR does not apply: The CGT rate was increased to 24% from 20%.

From our discussions with clients, we believe that despite the higher tax burden, selling a business remains a viable way to unlock capital and achieve a desired sale and exit. Employee Ownership sales are still at 0% CGT, thereby meaning that such sales remain an attractive option.

Recent M&A Deals

Avondale’s M&A deals during 2024 include Oryx Align purchasing SDT, DSW acquiring DR Solicitors, DX Group acquiring M.B. Freight Forwarding, Plus 4 Audio being sold to Britannia Row Productions Ltd, and Roycian acquiring McAndrew Martin.

Predictions

With interest rates starting to drop, borrowing costs are gradually following suit with a first reduction to 4.5% this month. There are long-tail signs that the cost of debt will decrease, placing banks and alternative lenders more centre-stage. Deferred payments and vendor loans have become de rigueur in the last few years due to high interest rates as they are generally cheaper and easier to obtain than third-party debt. However, with higher CGT tax bills, seller deal structures may shift toward demanding more cash upfront in 2025. Corporations may also choose to pay in full as they seek to buy and integrate acquisitions faster. This approach could gain traction as more certainty returns to an otherwise stagnant economy—despite the UK Government’s fighting talk about growth. Their fiscal policies seem to contradict those ambitions.

If the Ukraine war reaches a stalemate or a peace agreement can be brokered, it is increasingly likely that we will see a new Iron Curtain and markets may start to interpret this as a certainty. This, combined with AI-driven business model transformations, will put additional pressure on corporates to acquire new service lines and positive disruption of the market will continue to increase.

Most private companies have traditionally had price-earnings multiples ranging from 4x to 15x, depending on their size and earnings quality. Businesses with robust, long-term models and recovering earnings will be in a stronger position, as too many buyers chase too few quality acquisition opportunities. Conversely, weaker companies with poor balance sheets and damaged business models will present value-play opportunities for stronger acquirers.

Disclosure & diligence

Environmental, social and governance (“ESG”) is becoming increasingly central to due diligence. Beyond financials and operational risks, buyers are now assessing a target’s technological capabilities and automation readiness. The drive to transform efficiency is at the forefront, especially as many emerging mid-market businesses still fail to design their operations around lean concepts and scalable processes.

This gap presents an exciting opportunity for buyers. Acquirers who can integrate automation and advanced technology into these businesses will unlock significant value – streamlining operations, reducing costs, and improving margins. The ability to transform traditional business models into more agile, tech-enabled ones may ultimately differentiate successful acquirers from the rest of the market. Technology-led due diligence will extend to evaluating data quality, process automation potential, and integration capability with AI-driven solutions. Buyers are not just acquiring businesses; they are also acquiring platforms for future growth. PE will also need to learn how to become better operators as a focus on just being good financiers will not be enough to deliver the 3x plus yields on later exits that they have become accustomed to.

Employee Ownership Sales

Between 2011 and 2024, the sector maintained an average annual growth rate of 16%, compared to 2.2% for all active UK companies during the same period. This rapid expansion is attributed to several factors, including increased awareness of the benefits of employee ownership, supportive Government policies, and a growing number of business owners seeking succession solutions that preserve company culture and ensure long-term sustainability. Overall, the employee-owned sector is not only expanding in numbers but also contributing positively to the UK economy by fostering more resilient and productive businesses.

There are now 2,000 employee-owned trust (“EOT”) businesses in the UK, an increase of 250 in 2024. Avondale’s recent completions of Ambiente Tapas Restaurants, Primacare Mobility and Mayflower Group all demonstrate the advantages of these sales for qualifying emerging mid-market companies. Structured at full commercial value and 0% CGT tax, these sales demonstrate the benefits of selling to an EOT. It is anticipated that the trend towards more employee-owned businesses will continue in 2025.

Summary

To summarise, overall M&A volume slowed during 2024, particularly in terms of the ‘big-ticket’ deals. However, we expect the emerging mid-market sector to remain moderately active during 2025. M&A continues to be one of the few ways to create positive disruption, achieve synergies, gain economies of scale, and sustain growth in the face of low productivity. In many respects, this measured pace benefits both buyers and sellers, allowing them more time to get deals right.

Contact us

If you would like more information about our services or case studies on our recent EOT deals, please visit our website at https://avondale.co.uk. Alternatively, if you would like a free consultation with one of Avondale’s experienced M&A advisors, please call us at +44 (0)1737 240888, email us at av@avondale.co.uk, or fill out the attached form, and we will get in touch straight away.

This article has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for any specific tax, legal or accounting advice. Regulated advice bespoke to your circumstances is essential.