Entrepreneur’s Relief: What Does the Price Cut Actually Mean for Entrepreneur’s?

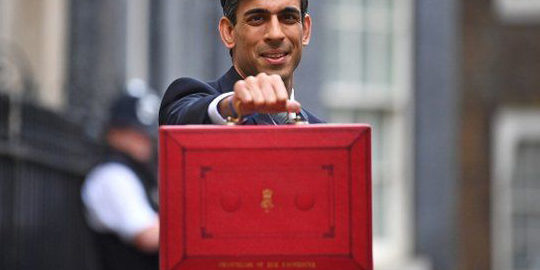

It looks as if the chancellor, Rishi Sunak, rather predictably, didn’t read my article “Could entrepreneurs’ relief be a benefit to the economy rather than a drain on the treasury?”.

Announced this afternoon in the budget statement, Entrepreneur’s Relief (ER) – the relief against capital gains tax aimed at people selling qualifying business assets (in most cases shares in privately-owned companies) – has been cut from a lifetime allowance of £10 million to £1 million. Whilst the rate remains the same; 10% instead of the standard 20% capital gains tax, the impact in certain circumstances could mean up to an additional £900,000 capital gains tax for some individuals.

Entrepreneur’s Relief was introduced in 2008 as a replacement for taper relief, itself a 1998 replacement for retirement relief.

The corporate finance and accounting communities have been repeatedly surprised as the relief has become more generous – with the lifetime allowance increasing in stages during 2010 and 2011 from £1 million to £2 million, then £5 million to the current level (up to yesterday) of £10 million.

Perhaps ER is now much closer to the original intent of retirement relief that afforded the small business owner who had perhaps sacrificed making pension contributions in favour of growing their business in the hope that one day the sale of that business would provide their pension pot.

For those with business valued below £1 million, there is no change. People with businesses valued between £1 million and £19 million will be affected the most (the closer to £10 million the greater the impact). Once you start getting to valuations beyond £19 million, I accept that the voting public are unlikely to be sympathetic to the plight of the entrepreneur in question. Most reasonable people today accept that we need to make a responsible contribution to our national overheads.

My advice to any entrepreneur whether considering a sale or in the middle of negotiations, remains the same as it always has: Consider whether the net sale proceeds allow you to achieve your objectives, particularly bearing in mind the certainty of capital compared to the risks of a privately owned business. If the numbers are beyond ‘requirement levels’, perhaps gross figures are fine for the purposes of ‘life’s scorecard’!

Further budget details can be found here.