From a legal perspective, when purchasing a company in the UK it is your job to check that everything is accurately represented. UK law operates on the principle of Caveat Emptor, which is derived from the Latin phrase, “quia ignorare non debuit quod jus alienum emit” meaning, ‘let a purchaser beware, for he ought not to be ignorant of the nature of the property which he is buying from another party’. Therefore, the diligent research and verification process, known as due diligence, must be conducted by buyers before finalising a purchase.

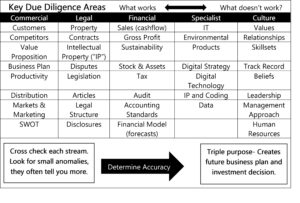

Due diligence is an in-depth exploration and review of a total environment and situation with specialist skills, care, tools, approaches, and attention to detail. Due diligence has a dual purpose – it seeks to protect the acquirer by managing risk and checking value. Still, it goes further in the ‘exploration’ as the check is also about discovery. What new opportunities does the acquisition afford and what map for growth post-acquisition can be drawn?

During the exploration process, it is inevitable that new elements will be uncovered. This is not necessarily a bad thing. Just because something is different, it does not mean an asset is worth less, indeed it may be worth more. Weaknesses may afford the greatest opportunity for growth. Invariably, due diligence can lead to a focus on negatives or the things we were not expecting. In these circumstances, the approach is to ask why things are different, and/or cross-check the information, and then assess whether it is positive or negative and what the likely impact might be. Even if there are negative aspects, it’s important to remember that the positives may outweigh them.

Alternatively, you should consider the following courses of action:

- Manage matters legally in warranties and indemnities.

- Further cross-checks and digging deeper to understand the issues better.

- Renegotiate either the deal structure or value.

- Delay until the negative is corrected.

- Withdraw – some of the best investment decisions are made by saying ‘no’.

Due Diligence Best Practice

Due Diligence Best Practice

Many practitioners are cynical about due diligence, based on some poor practices in the past, where buyers simply use the information to knock value. This thinking revolves around the idea that a buyer has beaten the competition to win a bid and therefore they are at their maximum plausible value. Their approach must consequently be to use due diligence information to deliberately erode deal value, at exactly the point sellers have become, after time and investment cost, more wedded and committed to a deal. The theory is that the negotiation power is with the buyer who has the final investment decision.

There is no question that this does occasionally occur, but it is not inevitable. It is, however, poor practice, and sellers will ideally remain objective. Having a realistic alternative strategy in place is critical and valuable, enabling any side to leverage a deal. Sellers do get frustrated with due diligence as it can be time-consuming, but like any aspect of business, preparation is of key importance. Buyers will always undertake due diligence and therefore pre-sale preparation by the seller is essential and is a key part of any value-creating work. Tidier contracts, financial models, and well-ordered information indicate a well-run business and make the due diligence and buyer investment decision much easier. Best practices will include:

The seller must respond honestly and openly.

- A simple system and a coordinated approach.

- Collating data to create one view for all advisors and management.

- Correct cataloguing/indexing.

- Cross-checking to determine accuracy.

- Strengths, weaknesses, opportunities, and threats.

- A deep dive – look at the business and the wider opportunities.

The Process

It is worth mentioning that as compliance has increased so has due diligence, and therefore it can take longer than it should. Preparation is the key to reducing this time as is organisation. Overall due diligence on a project, and its efficiency will depend on how it is initially set up. There are many techniques, tools, and advisors to help. Use a good system and advisory team and like any project ensure strong communications and ample resources. Due diligence as a practice comes from larger corporations, who are happy to maximise hours paid for advisors to hedge against risk and to create a corporate veil (someone else to blame) if matters go wrong. This can result in ticking boxes for the sake of ticking boxes; however, a good assessment includes:

- What does not work in the business but as importantly, what does?

- What are the skeletons in the cupboard, if any?

- What are the structural risks to the business?

- What is the value of Intellectual Property, process, or threats in market trends?

- Is the house well run and in order, against a professional team?

- What is the potential of the business and value drivers?

- What are the strategic plan and integration goals now that we understand the business better?

Cultural check

Most money is spent on financial, legal, and then commercial due diligence but rarely is a cultural assessment employed, yet 70% of CEOs site culture as the biggest tension point in M&A. Beliefs and values, motivations, how things are done, decision-making approaches and reporting all define a culture. One of the biggest challenges is the assumption that cultures are the same. A team is not a group of people who work together but a group who trust each other.

Summary

Due diligence is an essential, professional part of any transaction. It should be approached by both sides with proportionate analysis and appropriate investment. Due diligence can make or break deals, but if well organised, the process itself should be straightforward to avoid increasing tension. Good advisors will generally do the lifting to ensure a smooth experience for you.

Contact Avondale Corporate

Avondale would welcome the opportunity to discuss your exit options with you and help you plan for your future. Please call us at +44 (0)1737 240888, our Contact Us page or email av@avondale.co.uk to make an appointment. You can also visit our website at www.avondale.co.uk to learn more about our services.