The M&A (Mergers and Acquisitions) strategy in both a volatile market and a dynamic market should remain the central theme (Kevin Uphill ‘Creating Competitive Advantage’):

- Look at who your future customers will be.

- Take time out to think and research to lead ahead, rather than manage.

- What niche can you own, where you create pull not push?

- How do you do this with a lean, productive operational model?

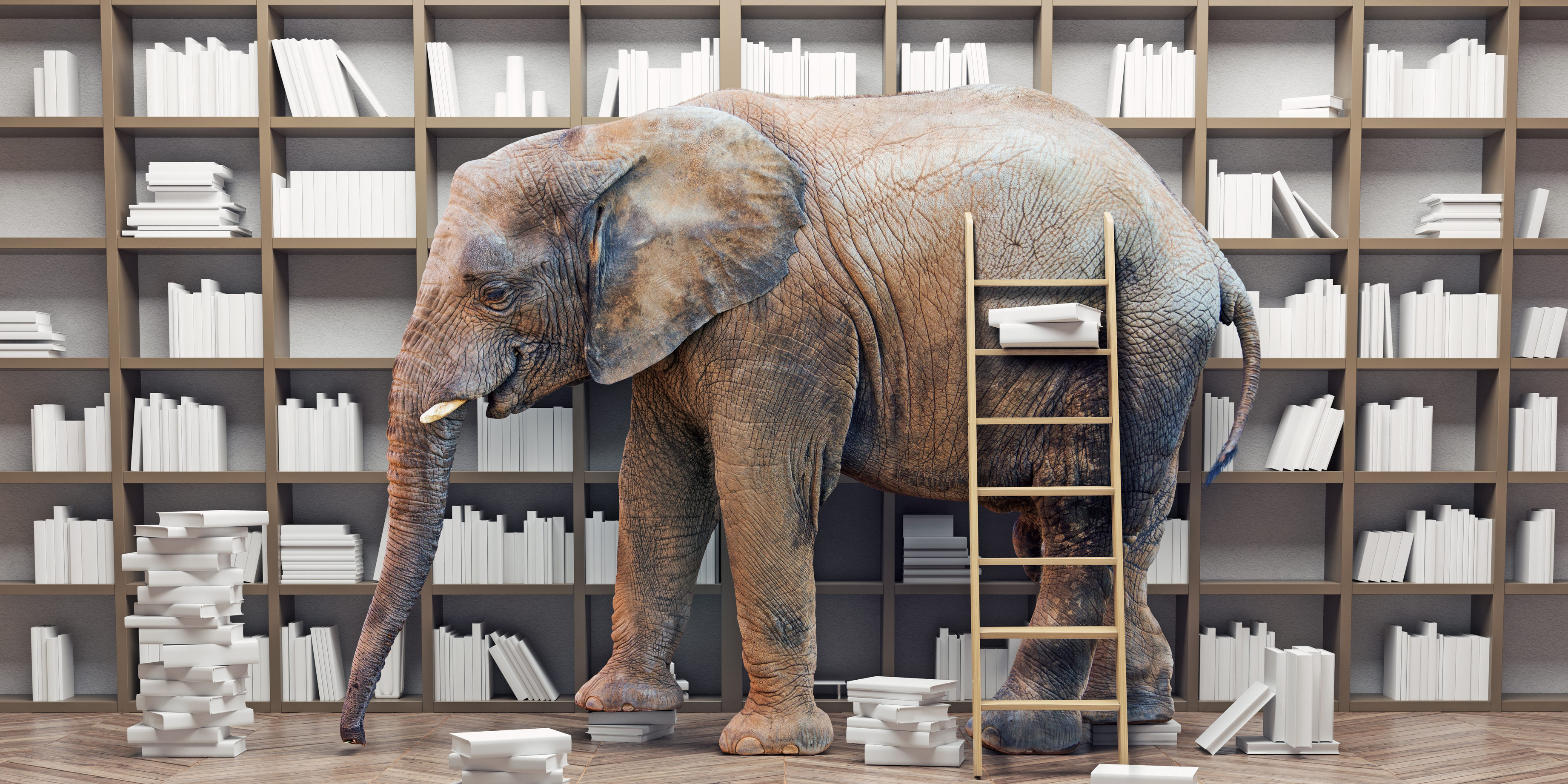

When you have the strategy, there may however be an ‘elephant in the room’, an awkward conclusion that you do not want to face. Simply put, identifying that ‘elephant’ is what your business needs to achieve the change faster. When organic growth is not enough, and you need new teams, know-how, products, and new markets to succeed, this is when you need Mergers and Acquisitions. The elephant in the room may be that you need to buy your way to ‘change’ however counterintuitive this may seem in an economic slowdown.

The difference between a volatile market and a dynamic market is that the global pandemic has accelerated change. This has enforced the need to have the best business model, whereby your customers seek you out rather than you having to persuade them to come to you.

This may be best achieved via mergers and acquisitions; a necessary cure for businesses wishing to survive in the increasingly volatile market. This may be as a trade buyer using M&A to shift the model or Private Equity buying into a good sector then using M&A in a buy and build strategy. In both cases the strategy sits around the four corners of M&A synergy (the ability to cross-sell), economies of scale (cost savings), shareholder value (scale and quality drive value multiples up), and finally, positive disruption (changing markets).

The State of The Volatile Market Today and The Attempts to Fix It

Governments are going to have to figure out how to pay for the lockdown. They could simply print money, but this risks inflation and the gap is too great for austerity to be the cure. It is more likely that they will invest their way out of the crisis by spending on an unprecedented scale, for example on their country’s infrastructure. Likewise, M&A may well be the corporate investment equivalent post-COVID-19. Whilst it requires nerves and careful execution, M&A may be the fastest way to create and build better businesses in the pandemic era as more businesses fail coming out of a recession than going into one there will be opportunity and divestment.

The winners will be the CEO’s and Private Equity with their $2.4 trillion acquisition war chest who come to terms with the volatile market and, despite the adversity we are all facing right now, use M&A carefully to design better businesses and change volatile markets.

Overall, global economic growth has been far weaker in the last ten years than the previous fifty post-war years, and the pandemic will ensure that economies and the volatile market they currently inhabit continue to flatline. The truth is, value and yield can only be gained by being proactive and simply being better. Pulling together average companies to create world-beating companies by identifying the ‘elephant’ through clear leadership and thinking, and firmly pushing it out of that lockdown door. M&A may be the most important tool you now have to achieve that.

For an exploratory discussion without obligation, please contact us on +44(0)20 7788 8250 or email av@avondale.co.uk.

We have launched our ‘Lead Ahead’ Webinar Series in line with our weekly articles. Watch our ‘Mergers and Acquisitions Post Covid-19’ webinar here to understand why over 150 companies adopted this model in the last year.

For information on other webinars within the series, visit our Events page.